high iv stocks meaning

High Implied Volatility Put Options 31032022. IV is the short term sentiment about the given stock that drives the option prices.

/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-01-ee4f3ae7447541368fd404e8bf9e987e.jpg)

The Volatility Index Reading Market Sentiment

Defining standard deviation First lets define standard deviation and how it relates to IV.

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

. Intrinsic value is an options inherent value or an options equity. Zee Entertainment Enterprises Lt. This value tells us how high or low the current value is compared with the past.

This can show the list of option contract carries very high and low implied volatility. With an options IV you can calculate an expected range the high and low of the stock by expiration. High iv stocks meaning Tuesday February 22 2022 Edit.

For example one stock might have an implied volatility of 30 while another has an implied volatility of 50. Right now for example the Microsoft 100 call option that expires in about a month has an IV of 34. It is seen that a surge in stock price results in exponential gain in option price which is not necessarily linear in nature and is result of implied volatility of the stock.

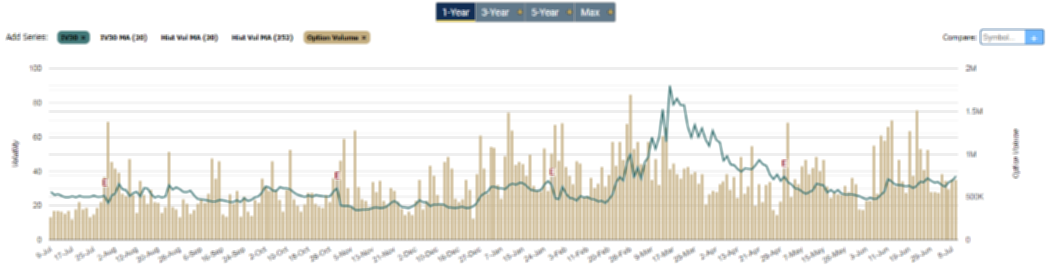

Before we start scanning for stocks with high implied volatility IV lets make sure that we have a really solid understanding of exactly what IV is. IV is quite useful in projecting a few things such as future price moves supply and demand and pricing options contracts. Implied Volatility percentile is a ranking method to compare implied volatility to its past values.

In financial mathematics the implied volatility of an option contract is that value of the volatility of the underlying instrument which when input in an option pricing model will return a theoretical value equal to the current. Its expressed as a percentage. If IV Rank is 100 this means the IV is at its highest level over the past 1-year.

If you own a 50 call option on a stock that is trading at 60 this means that you can buy the stock at. Implied volatility rises when the demand for an option increases and decreases with a lesser demand. Implied volatility percentile IV percentile tells you the percentage of days in the past that a stocks IV was lower than its current IV.

But keep in mind that volatility increases the chance of profit at the same time it can increase the chance of loss. What does that mean. Implied volatility tells you whether the market agrees with your outlook which helps you measure a trades risk and potential reward.

Implied volatility is a statistical measurement that attempts to predict how much a stock price will move in the coming year. 10 25 50 100 All. It is a percentile number so it varies between 0 and 100.

Implied volatility is basically an estimated price move of a stock over the next 12 months. By understanding both IV and IV rank you can determine the. Put simply IVP tells you the percentage of time that the IV in the past has been lower than current IV.

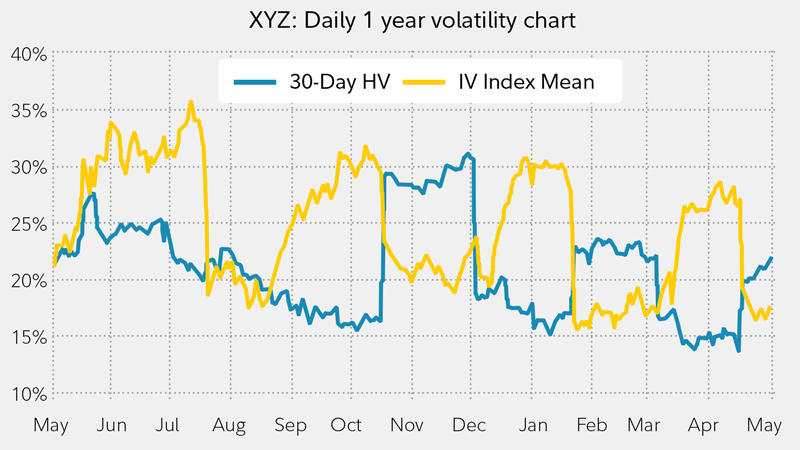

An options strategy that looks to profit from a. IV Rank is the at-the-money ATM average implied volatility relative to the highest and lowest values over the past 1-year. If the IV30 Rank is above 70 that would be considered elevated.

This will increase their intraday profitability and amount of gains. Typically we color-code these numbers by showing them in a red color. IV rank or implied volatility rank is a metric used to identify a securitys implied volatility compared to its Implied Volatility history.

IV percentile IVP is a relative measure of Implied Volatility that compares current IV of a stock to its own Implied Volatility in the past. IV is the reason two stocks trading at 100 will have completely different option prices for the same strike and expiration. Microsoft stock is currently trading at 100 per share.

A humanitarian crisis restricted energy flows Europes security order - the impact of Russias invasion of Ukraine could be felt far and wide. Also we have several factors that come into play when calculating implied volatility. Learn how Implied Volatility IV can be a valuable tool for options traders to help identify stocks that could make a big price move.

Gujarat Narmada Valley Fertilize. It is also a measure of investors predictions about future volatility of the underlying stock. High IV strategies are used by traders most commonly in high volatility environments.

70 would mean that over the past year 252 trading days the current value is higher than 70 of the observations. A high IVP number typically above 80 says that IV is high and a low IVP. It can help trader to find the strike to buy or sell.

But we have understood that intraday traders need to concentrate only on high volatile stocks NSE or any other exchange. As an example lets say a stocks current IV is 35 and in 180 of the past 252 days the stocks IV has been below 35. Learn more about implied volatility strategies from tastytrade.

Typically you will see higher-priced option premiums on options with high volatility and cheaper premiums with low volatility. Put Options Screener with High Implied Volatility - Indian Stocks. Heres the formula for calculating a one-year IV percentile.

Implied volatility is a metric used to forecast the likelihood of movement in a securitys price. An IV of 20 means that there is a 68 chance 1 SD this 100 stock will move 20 on either side in a year which is. The ranking is standardized from 0-100 where 0 is the lowest value in recent history and 100 is the highest value.

Continue reading What is implied volatility percentile IV. As the implied volatility rank is very high close to the maximum of 100 it means that the option is in fact expensive when its historical implied volatility is taken into account.

What Is Implied Volatility Option Value Calculator

Take Advantage Of Volatility With Options Fidelity

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Volatility Smile Definition And Uses

What Is Implied Volatility Option Value Calculator

Spy Implied Volatility Chart Spdr S P 500 Etf Trust

Spy Implied Volatility Chart Spdr S P 500 Etf Trust

What Is High Iv In Options And How Does It Affect Returns

What Is Volatility Definition Causes Significance In The Market

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

Iv Crush What It Is How To Avoid It Or Take Advantage Of It

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

:max_bytes(150000):strip_icc()/dotdash_INV_final-Profiting-From-Position-Delta-Neutral-Trading_Feb_2021-02-5e3940a27b30422bb071e5a53f386d05.jpg)

Profiting From Position Delta Neutral Trading

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/skwesmile-56a6d2125f9b58b7d0e4f70a.gif)

/skwesmile-56a6d2125f9b58b7d0e4f70a.gif)

:max_bytes(150000):strip_icc()/VolatilitySkew2-17197b230fb84ea9ae62955e956ffe0c.png)

/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Use_Options_Data_To_Predict_Stock_Market_Direction_Dec_2020-01-aea8faafd6b3449f93a61f05c9910314.jpg)